Have you ever wondered how much it costs to insure a travel baseball team? It’s a question many coaches and parents ask. When your young athletes hit the road for games, safety is key. But what about insurance?

Imagine you’re packing the car for an exciting weekend of baseball. The kids are buzzing with energy. But then, a thought hits you—what happens if someone gets hurt during a game? That’s where insurance comes in. It helps protect players, coaches, and even the team’s gear.

Here’s a fun fact: insurance costs can vary widely. Factors like team size, age, and the number of tournaments matter. Did you know that some teams find affordable options for great coverage?

In this article, we’ll dive into the details of how much insurance for a travel baseball team really is. Let’s explore what you need to know!

How Much Is Insurance For A Travel Baseball Team?

How Much is Insurance for a Travel Baseball Team?

Finding the right insurance for a travel baseball team can seem tricky. Prices often range from $500 to $2,000 a year, depending on the team’s size and coverage needs. Imagine your team gearing up for an exciting tournament! You wouldn’t want accidents or injuries to ruin the fun. Good insurance protects the players and gives peace of mind to parents. Knowing the costs helps teams choose wisely and keep everyone safe on the field!Understanding Travel Baseball Team Insurance

Definition and purpose of insurance for travel baseball teams. Importance of insurance in protecting teams from various risks.Insurance for travel baseball teams guards against various hiccups, like injuries and equipment losses. Think of it as a safety net! If a player gets hurt or a crucial bat goes missing, insurance swoops in to help. Without it, teams could face hefty bills, making them cry more than a struck-out player. Protecting your team isn’t just smart; it’s essential!

| Risk | Importance of Insurance |

|---|---|

| Player Injuries | It covers medical costs, keeping kids on the field. |

| Equipment Damage | Replaces lost or damaged gear, avoiding hefty expenses. |

| Event Cancellations | Protects against financial loss, ensuring teams stay afloat. |

Factors Influencing the Cost of Insurance

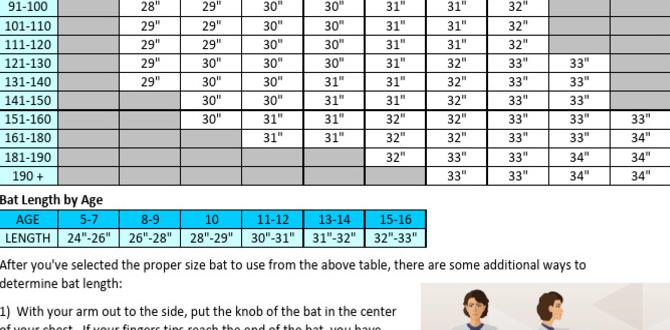

Key factors that affect insurance premiums (e.g., team size, location, and age of players). Discussion on how activity level and field use impact costs.Many factors can change how much insurance costs for a travel baseball team. Team size is a big one. More players mean higher costs. Location also matters; certain areas have higher risks. The age of players can influence rates too. Younger players may lead to lower premiums. Finally, how active the team is and the number of times fields are used can add to expenses. More playing time means more chances for accidents.

What affects travel baseball team insurance costs?

Cost can vary based on team size, location, player age, activity level, and field use.

- Team size

- Location

- Age of players

- Activity level

- Field use

Average Insurance Costs for Travel Baseball Teams

Statistical data on typical insurance costs for teams at different levels. Comparison of costs between various insurance providers.Insurance for travel baseball teams can vary quite a bit. On average, teams might spend between $200 to $800 a year. This depends on the team’s level and the insurance provider. For instance, beginners could pay around $200, while advanced teams might face costs of $600. It’s wise to compare prices, as different providers have different packages. Here’s a simple comparison:

| Team Level | Average Cost | Provider Example |

|---|---|---|

| Beginners | $200 – $300 | Provider A |

| Intermediate | $400 – $500 | Provider B |

| Advanced | $600 – $800 | Provider C |

Make sure to shop around, as one provider thinks a baseball is just a ball, while another thinks it’s a priceless treasure! Happy searching!

Ways to Reduce Insurance Costs

Strategies for minimizing premiums through risk management and safety protocols. The impact of group insurance policies for multiple teams.To save on insurance costs, start by improving safety measures on the field. Training players and coaches on safety can cut risks and lower premiums. According to studies, teams focusing on safety can save up to 30% on their insurance! Group insurance policies for multiple teams can also work wonders. Not only do they offer better rates, but they also make it easier to manage. After all, who wants to juggle a dozen popcorns when they can have one big bucket?

| Strategy | Potential Savings |

|---|---|

| Implement Safety Training | Up to 30% |

| Group Insurance Policies | Lower Premiums |

Choosing the Right Insurance Provider

Tips for selecting a reliable insurance provider for travel baseball teams. Questions to ask potential insurers before purchasing a policy.Finding the best insurance for your travel baseball team is key. Look for a trustworthy provider who knows sports. Ask these questions:

- What types of coverage do you offer?

- How long have you been in business?

- Do you have experience with youth sports teams?

- Can you provide references?

Checking these details can save you stress and money. Look for reviews and recommendations too. Make sure you feel confident with your choice.

What should I ask when choosing an insurance provider?

Be sure to ask about coverage details, business experience, and team references. This helps ensure you pick the right insurance for your team’s needs.

Real-Life Case Studies and Examples

Analysis of specific cases where insurance saved a travel baseball team from financial loss. Testimonials from teams about their insurance experiences.Insurance can be a hero for travel baseball teams. One team faced a big problem when a player got injured during a game. Thanks to their insurance, they didn’t have to pay a huge medical bill. Another team shared how their insurance helped them recover losses from a stolen equipment trailer. They said, “Without insurance, we’d be out of the game and broke!” Here’s a quick look at how insurance can save the day:

| Team | Scenario | Insurance Benefit |

|---|---|---|

| All-Star Aces | Injury during game | Covered medical expenses |

| Diamond Dodgers | Theft of equipment | Reimbursed for stolen gear |

These stories remind us that insurance is like a trusty glove—always ready to catch a falling ball!

FAQs about Travel Baseball Team Insurance

Common questions and answers regarding insurance coverage and costs. Clarifications on terms and conditions that teams should be aware of.Travel baseball teams often have many questions about insurance. It’s smart to understand what they need. Here are some common inquiries:

What does travel baseball team insurance cover?

Insurance usually covers injuries, property damage, and legal fees. It helps protect teams during games and practices.

How much does it cost?

The cost can vary. On average, teams might pay $500 to $1,500 each year. Factors like team size and location matter.

Important Terms to Know:

- Liability Coverage: Protects against claims made by others.

- Accident Coverage: Covers expenses if a player gets hurt.

- Exclusions: Know what is not covered in the policy.

Always read the policy carefully. Understanding these details helps teams stay safe and ready to play.

Conclusion

In summary, insurance for a travel baseball team can vary widely in cost. Factors include team size, location, and coverage type. You should compare different options to find what works best for your team. Remember, having the right insurance protects your players and your budget. For more details, check online resources or talk to an insurance agent.FAQs

Sure! Here Are Five Related Questions On The Topic Of Insurance For A Travel Baseball Team:Sure! A travel baseball team needs insurance to protect players and families. It helps cover costs if someone gets hurt. Insurance can also pay for lost equipment. By getting insurance, we keep everyone safe and worry less while playing. It’s important to check that we have the right coverage.

Sure! Please provide the question you’d like me to answer.

What Types Of Insurance Coverage Are Typically Recommended For A Travel Baseball Team?For a travel baseball team, you should have a few types of insurance. First, general liability insurance helps if someone gets hurt or their stuff gets damaged. You might also want accident insurance for players, so they are covered if they get injured. Another good option is equipment insurance, which helps if bats or gloves get lost or broken. These coverages help keep everyone safe and protect your team.

How Does The Cost Of Insurance For A Travel Baseball Team Vary Based On Team Size And Location?The cost of insurance for a travel baseball team can change based on how many players are on the team and where you play. Bigger teams usually need more insurance, which can make it cost more. Also, if you play in a busy city, insurance might be pricier than in a small town. So, we should think about team size and location when figuring out insurance costs.

Are There Specific Insurance Providers That Specialize In Coverage For Youth Sports Teams, Including Travel Baseball?Yes, there are insurance companies that focus on youth sports teams. They know what teams like travel baseball need. You can find providers that offer special plans for injuries, equipment, and accidents. It’s smart to ask your coach or league about these options. They’ll help you get the right coverage.

What Factors Can Influence The Premiums For Travel Baseball Team Insurance, And How Can Teams Potentially Lower Their Costs?Some factors that can affect travel baseball team insurance costs are the number of players, age of the kids, and where you play. If your team has more players, the cost might go up. You can lower your costs by having a safe team, following rules, and keeping players healthy. Shopping around for different insurance options can also help you find better prices.

Does Liability Insurance For A Travel Baseball Team Cover Injuries Sustained By Players During Practices And Games?Yes, liability insurance for a travel baseball team usually covers injuries to players during practices and games. This means if someone gets hurt while playing, the insurance can help pay for medical bills. However, it’s important to check with your team to understand all the details. Always ask questions if you’re unsure!